This software company is slowly recovering from the COVID-19 pandemic bubble.

Shopify (SHOP -1.96%) is still in the middle of its 2021 hangover, as shares are down 15% from all-time highs set during the COVID-19 pandemic stock market bubble. The stock is up over 100% in the last 12 months, but still has not eclipsed previous highs after going through a brutal drawdown in 2022. At the same time, business performance has been rock-solid if not stellar, as management keeps adding new commerce tools and attracting new businesses to join the platform.

With Shopify stock still down from all-time highs, should you buy shares in 2025 for your portfolio? Here’s what the numbers say.

Steady global expansion

As a software and payments provider for online businesses, Shopify has grown to dominate the North American market. Now, it is moving internationally.

Last quarter, growth in payments volume for its European division was 42%, outpacing overall growth. The company has built up a best-in-class set of tools for entrepreneurs and businesses of all sizes to sell and process payments online. Last quarter, even Starbucks signed a deal with Shopify, which shows the capabilities of the platform for online shopping.

Overall revenue grew 31% year over year in the quarter, with strong growth expected for the rest of the year. Profit margins remain strong, with free cash flow margins of 16% in the quarter. This combination of growth and profitability is impressive and the key reason why Shopify’s stock has soared in the last 12 months.

As more and more businesses sign up for Shopify’s software tools and payment processing, the more growth Shopify will achieve. Add new features such as advertising and the Shop Pay application for consumers, and it looks like growth will continue for many years into the future.

Image source: Getty Images.

AI, crypto, and new products

Shopify is embracing new technologies as a way to leverage more usage from its business customers. It now has two artificial intelligence (AI) services called Sidekick and Magic that help analyze trends for a business, create content, and marketing products. Providing more value for enterprises will help customers stay entrenched within the Shopify ecosystem, leading to revenue growth and pricing power.

What’s more, Shopify is now beginning to expand and accept more forms of payment, such as Circle‘s stablecoin USDC. This should help with cross-border transactions and make it easier for shoppers who want to pay in different ways on Shopify’s e-commerce storefronts. It will not only help drive new payment growth (which directly translates to revenue for Shopify), but also adoption of shopping across borders.

On the whole, Shopify is building a huge ecosystem of products for businesses trying to sell things online. Its breadth of tools is unmatched in the software world, which is why so many commerce companies are signing deals with them. Expect this growth to continue for many years, as long as product innovation remains top tier.

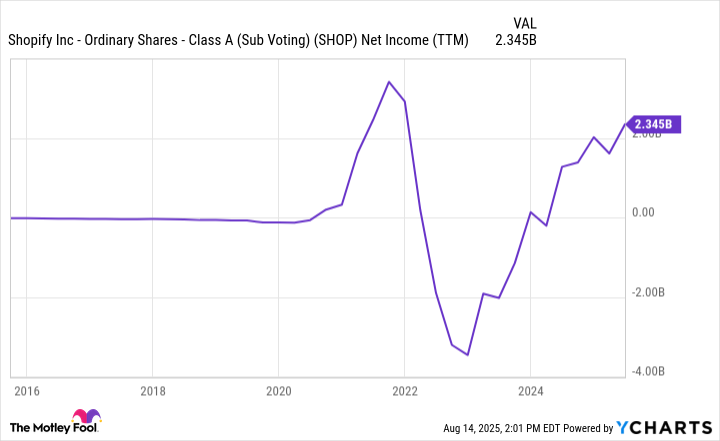

SHOP Net Income (TTM) data by YCharts

Should you buy Shopify stock?

Shopify is a fast-growing business, but that does not necessarily make the stock a buy. Total revenue was $10 billion over the last 12 months. Revenue growth is expected to be over 20% for the rest of 2025.

At the same time, 20%-plus growth cannot continue forever, no matter what company you are. On a long-enough timeline, a growth rate significantly above global economic growth would mean absorbing the entire global economy, which is not going to happen (no matter how good Shopify’s commerce tools are). Revenue growth will be strong for many years, but it will eventually slow for Shopify.

If Shopify’s revenue grows at an average rate of 15% for the next five years, it will reach $20 billion in revenue by 2030. With a gross profit margin of 50%, I believe that Shopify can achieve a 20% net income margin once the business matures. This would turn $20 billion in revenue into $4 billion in annual net earnings five years from now.

Today, Shopify has a market cap of $187 billion, which would give the stock a forward price-to-earnings ratio (P/E) of 47 based on these earnings growth projections. Despite how good of a business it is, this nosebleed P/E ratio means investors should avoid Shopify stock after its recent 100% run over the last 12 months.

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Shopify and Starbucks. The Motley Fool has a disclosure policy.