America’s largest bank has been a moneymaker for its shareholders, with annualized returns exceeding 25% during the past five years.

Sometimes, it feels like bank stocks carry a stigma.

Perhaps it’s the persona of the extremely wealthy, the “suits” as some on social media might call them, that some associate with big banks. Maybe it’s a result of the political backlash from the financial aid some banks received during the 2007-2009 financial crisis. Or, it could be that banks are complicated businesses that even professional analysts can struggle to sift through.

The Motley Fool dove into the financial sector and reported on the world’s largest financial companies by market cap. JPMorgan Chase (JPM 0.16%) checked in at No. 2, after Berkshire Hathaway. America’s largest bank has delivered strong returns for shareholders, with annualized investment returns exceeding 25% during the past five years.

Is the stock still a buy, or has this big bank stock peaked? Here is what you need to know.

Image source: Getty Images.

A lucrative business with a virtually impenetrable moat

Big banks like JPMorgan Chase touch almost every aspect of the economy. They are involved in a wide range of financial products and services, including (but not limited to) consumer and business banking, mortgages, investment management, and student lending. A bank’s finances are a complicated web, but a bank’s primary function is lending money at higher rates than it pays to depositors.

There are two competitive advantages in that game: size and stickiness. Let me explain.

Larger banks have more resources to invest in areas such as technology to analyze and act on data, marketing to attract customers, and cheaper access to capital that they can use to undercut smaller competitors. It’s a significant reason big banks continue to grow larger, while the total number of banks and credit unions in the U.S. has steadily declined.

JPMorgan Chase is America’s largest bank with more than $4.3 trillion in assets. It offers practically every financial product or service you could imagine. A customer is more likely to stick with JPMorgan Chase as they use them for more of their financial needs.

It’s hard to see anything other than government regulation threatening the wide moat JPMorgan and other large U.S. banks enjoy.

Why JPMorgan Chase will likely continue to grow

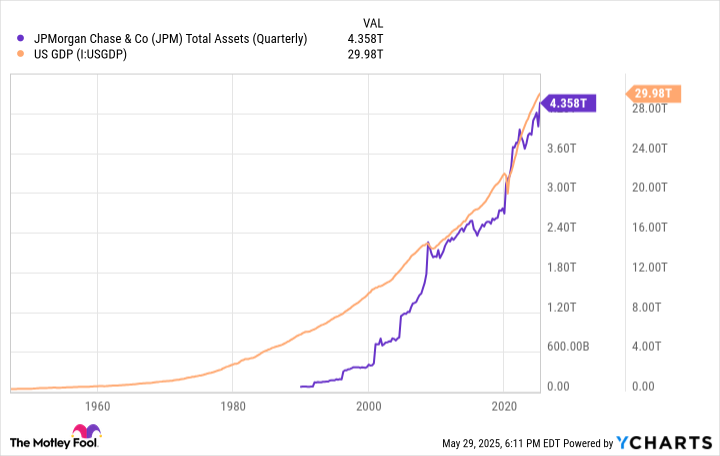

Since JPMorgan Chase is essentially everywhere in the economy, it is likely to grow in tandem with it. That trend has played out for years:

JPM Total Assets (Quarterly) data by YCharts

A bank also benefits from inflation, where asset prices, home values, and loan sizes all grow over time. The catch is that recessions can hurt banks when people and businesses spend and borrow less, and loan defaults rise.

It’s a part of investing in bank stocks, though it’s worth noting that the 2007-2009 financial crisis was one of the worst events in the financial sector since the Great Depression. Some banks didn’t survive, but JPMorgan Chase did, and has thrived in recent years. The stock has outperformed the S&P 500 index by a wide margin during the past decade.

Is the stock a buy?

Here’s the problem for investors now. JPMorgan Chase stock currently trades at about 2.2 times its book value, near its highest valuation during the past decade. That’s not ideal when the economy is showing multiple signs of potential weakness including:

- U.S. household credit card debt is at an all-time high.

- Auto loan delinquencies are at decade-highs, excluding a spike during the pandemic.

- Student loan repayments are fully resuming after a multiyear pandemic freeze.

- Interest rates are rising, squeezing demand for mortgages and other loans.

Even JPMorgan Chase’s chief executive officer, Jamie Dimon, has publicly expressed concern for the economy’s direction. Although JPMorgan is a world-class business and bank, it’s tough to justify paying such a high valuation for a company that could soon be subjected to a weaker economy than it has enjoyed for most of the past five years.

Nobody can predict these things with certainty, but investors may be wise to tread lightly here.

JPMorgan Chase is an advertising partner of Motley Fool Money. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends JPMorgan Chase. The Motley Fool has a disclosure policy.