The hot artificial intelligence (AI) market has birthed a number of high-flying AI stocks. One of these is BigBear.ai (BBAI 0.88%).

The company’s share price soared more than 200% over the past 12 months through June 18. The stock hit a 52-week high of $10.36 in February after President Donald Trump announced Project Stargate, which aims to invest billions of dollars into the AI sector.

Since then, BigBear.ai stock is down more than 50% from its peak. Does this present an opportunity to scoop up the company’s shares for cheap?

Image source: Getty Images.

Why BigBear.ai’s shares plummeted

A confluence of factors led to the decline in BigBear.ai stock this year. One is Wall Street’s concerns about the unpredictable macroeconomic environment, exacerbated by the Trump administration’s tariff approach.

On top of that, the federal government is cutting budgets. This is worrying because BigBear.ai delivers AI solutions centered around national security and infrastructure. Consequently, the bulk of company revenue comes from federal government contracts.

Adding to this mix, in March, BigBear.ai disclosed a material weakness in its internal controls for financial reporting, contributing to the company’s share price decline. As a result, the company restated the last few years’ worth of financial statements. While unrelated, CFO Julie Peffer departed in June.

This wasn’t 2025’s only leadership change. In January, BigBear.ai gained a new CEO, Kevin McAleenan, who had served as Acting Secretary of the U.S. Department of Homeland Security during President Trump’s first term.

BigBear.ai’s financial picture

BigBear.ai’s leadership changes may be a good outcome over the long run. McAleenan’s experience with the previous Trump administration could help BigBear.ai survive the government budget cuts.

In addition, under the previous CEO, the company fell short of its 2024 goal to achieve at least $165 million in sales, coming in at $158.2 million last year. With McAleenan taking over, perhaps BigBear.ai can meet its 2025 full-year revenue target, which ranges between $160 million and $180 million. He will have to succeed to win shareholder confidence in his leadership.

It’s too early to tell if McAleenan can deliver, since he only has the first quarter under his belt. BigBear.ai brought in $34.8 million in Q1 sales, a 5% year-over-year increase.

However, the company’s balance sheet includes a sizable chunk of debt. Of its $198.5 million in total Q1 liabilities, $101.4 million was debt. Q1 total assets were 396.3 million with $107.6 million of that in cash and equivalents.

Moreover, despite year-over-year sales growth, BigBear.ai is not profitable. It exited Q1 with a net loss of $62 million.

Deciding whether to buy BigBear.ai stock

It’s not uncommon for tech companies to operate at a loss, but in these cases, you want to see sales growing rapidly. With just a 5% year-over-year increase in Q1 revenue, BigBear.ai is not achieving strong growth, especially for the hot field of artificial intelligence. This raises questions about the company’s ability to capture customers, let alone eventually achieve profitability.

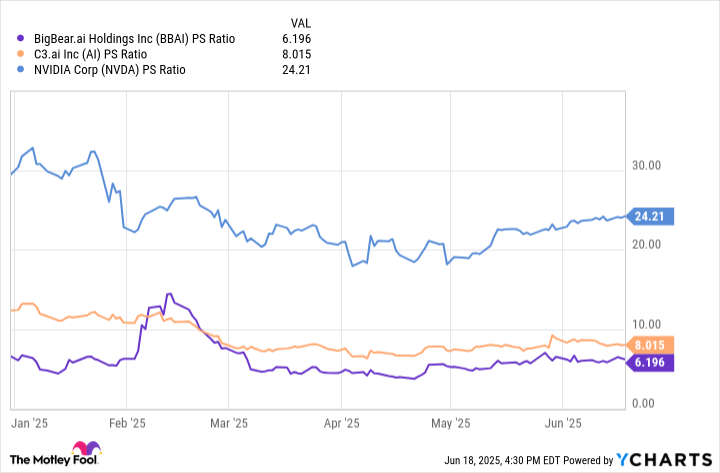

BigBear.ai’s stock valuation is another factor to consider. The price-to-sales (P/S) ratio is useful for this purpose, since it measures how much investors are willing to pay for every dollar of revenue.

This metric is commonly used with companies that aren’t profitable. Comparing it to artificial intelligence leader Nvidia, as well as C3.ai, a competitor also operating in the government AI sector, helps to understand BigBear.ai’s share price valuation.

Data by YCharts.

The chart shows BigBear.ai’s P/S multiple is the lowest of the three AI companies, and it’s down significantly from where it was at in February. This suggests BigBear.ai shares are attractively valued.

However, Nvidia and C3.ai warrant higher valuations because of their business performance. For example, Nvidia’s revenue rose 69% year over year to $44.1 billion in its fiscal Q1, ended April 27. Meanwhile, C3.ai’s revenue of $108.7 million in its fiscal fourth quarter, ended April 30, represented a 26% year-over-year increase.

BigBear.ai’s mediocre AI revenue growth, debt, and the factors that led to its share price decline this year means investing in the company is risky. As a result, it’s best to hold off buying. Instead, watch its business performance over the next few quarters to see if it can strengthen sales before reconsidering BigBear.ai stock.