Investors considering which of these two stocks to buy right now have an easy choice to make.

CoreWeave (CRWV -3.65%) and Nebius Group (NBIS -1.51%) have witnessed a rapid jump in their share prices this year. Investors have been buying these stocks hand over fist because they are benefiting big time from the growing demand for cloud-based artificial intelligence (AI) infrastructure.

CoreWeave stock has shot up a remarkable 224% in just four months since going public in March this year, and Nebius has clocked healthy gains of 84% so far in 2025. Both companies are in the business of renting out data centers powered by graphics processing units (GPUs), which their customers use to train AI models, build applications, and scale up those applications in the cloud.

But if you have to choose one of these two stocks for your portfolio right now, which one should it be? Let’s find out.

Image source: Getty Images.

The case for CoreWeave

CoreWeave’s rally since its initial public offering (IPO) can be attributed to the terrific growth in the company’s revenue and backlog. Its top line jumped by more than fivefold in the first quarter to $981 million, and it’s on track to sustain its outstanding momentum.

That’s because the cloud infrastructure-as-a-service market in which CoreWeave operates is growing at an incredible pace. Grand View Research estimates that the cloud AI market could generate $650 billion in annual revenue in 2030, nearly 7.5 times the size of this market last year. CoreWeave is capitalizing on this lucrative opportunity by offering access to the top-of-the-line GPUs from Nvidia along with server processors from AMD.

The company claims that customers using its cloud AI infrastructure enjoy significant cost and performance advantages. It says its infrastructure is “purpose-built for compute-intensive workloads, and everything from our servers to our storage and networking solutions are designed to deliver best-in-class performance.”

The demand for the company’s AI infrastructure is outpacing supply, so it is focused on scaling up its capacity quickly to satisfy the strong demand. Management said on its May earnings conference call that it has raised over $21 billion to expand infrastructure and data center capacity.

The company recently announced the upcoming $9 billion acquisition of Core Scientific, which could bring another 1 gigawatt (GW) of data center capacity and help lower its costs from its existing leases with Core Scientific.

CoreWeave forecasts a reduction of over $10 billion in future lease liabilities once the acquisition is complete, followed by annual run-rate cost savings of $500 million by the end of 2027. Before this acquisition was announced, CoreWeave was projecting a fourfold increase in its data center capacity under its existing capacity contracts.

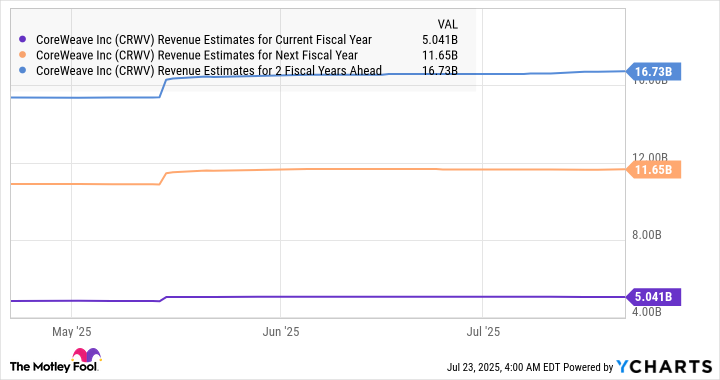

This focus on enhancing data center capacity should pave the way for outstanding growth for CoreWeave since it was sitting on a revenue backlog of almost $26 billion at the end of the first quarter — 63% higher from the year-ago period. As such, analysts are expecting its revenue to continue increasing at a strong pace.

CRWV Revenue Estimates for Current Fiscal Year; data by YCharts.

CoreWeave is likely to remain a top AI stock since it is serving a fast-growing market and is investing aggressively to capture a share of it.

The case for Nebius

Nebius shot up impressively last week after Goldman Sachs put a 12-month price target of $68 on the stock. The investment bank said that the company’s full-stack AI infrastructure, which includes hardware and software tools, allows it to make the most of the impressive opportunity in this space.

Goldman’s price target calls for a 31% jump in the stock in the coming year. And there is a good chance that the company could surpass that given its 385% revenue jump year over year in the first quarter to $55 million. More importantly, the growth in its annual revenue run rate was much faster at 684% year over year to $249 million.

That improved to $310 million in April, and the company forecasts an annual revenue run rate of $750 million to $1 billion by the end of the year, driven by the new data center capacity it is planning. In a letter to shareholders, CEO Arkady Volozh said:

We are rapidly expanding our capacity footprint. In just three quarters, we’ve gone from one location in Finland to five locations across Europe, the U.S., and now the Middle East. We are actively exploring new sites in the U.S. and around the world, and we expect to provide more news on this soon.

Unlike CoreWeave, Nebius provides more than just AI hardware infrastructure to customers. Its cloud platform also offers developer tools and services that customers can employ to refine their AI models, run inference tasks, and develop custom solutions. This is why Goldman believes that Nebius could be a leader in the cloud AI space.

The company’s balance sheet — with $1.45 billion in cash and $188 million in debt — allows it to continue putting more money into its cloud infrastructure. This explains the healthy top-line growth it is projected to deliver.

NBIS Revenue Estimates for Current Fiscal Year; data by YCharts.

So, like CoreWeave, Nebius is likely to remain a high-growth company. But is it a better buy than its larger peer at this point?

The verdict

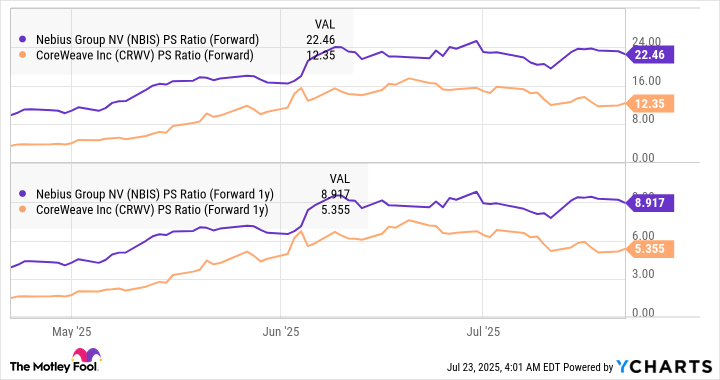

Both CoreWeave and Nebius are growing at healthy rates and are expected to sustain that. So, investors should look at their valuations to decide which is the better buy.

The two companies aren’t profitable right now considering their aggressive infrastructure investments, so we need to compare their price-to-sales ratios (P/S).

NBIS PS Ratio (Forward); data by YCharts.

Nebius stock is way more expensive than CoreWeave when comparing sales multiples, indicating that the latter is a better buy even after its strong rally this year. Moreover, CoreWeave is growing faster, has a huge backlog, and is sitting on ample resources to continue expanding its data center footprint, making it the easy choice for investors considering which of these two AI stocks is worth adding to their portfolios right now.