Two of the leading artificial intelligence (AI) stocks over the past year are Palantir Technologies (PLTR 7.69%) and BigBear.ai (BBAI 7.88%). Palantir’s stock has surged nearly 500% over the past year, while BigBear.ai’s stock has jumped more than 150%, as of this writing.

With both stocks performing well, let’s look at which one is likely to outperform over the long run.

A focus on the defense industry

Both Palantir and BigBear.ai have strong ties to the U.S. federal government and the defense industry. Palantir was founded with the idea that it could take fraud protection tools like those used by PayPal to help uncover hidden threats and protect the U.S. from terrorists following the Sept. 11 terrorist attack.

Palantir’s first product, Gotham, can gather and analyze data from a vast and wide array of data sets and has been used by the government for such things as identifying and tracking terrorist financing, as well as locating high-value targets in military zones. The U.S. government remains Palantir’s largest customer today, accounting for 42% of its revenue last quarter.

BigBear.ai, meanwhile, was formed when private equity firm AI Industrial Partners merged analytics company BigBear and systems integrator NuWave together, later adding two other analytic companies and taking it public through a special purpose acquisition company (SPAC) back in 2021. The company is largely a government contractor, with a focus on defense, national security, and IT modernization. It has been awarded contracts with a number of government agencies, including the Department of Defense (DoD), National Security Agency (NSA), Department of Homeland Security, and the Federal Aviation Administration (FAA).

Image source: Getty Images.

Outside the public sector, Palantir’s biggest area of growth has come from U.S. commercial customers that have embraced its Artificial Intelligence Platform (AIP), which works as an orchestration layer that allows users to apply AI models to help solve real-world problems. The platform can be used for a plethora of tasks across disparate industries, with everyone from hospital operators to pipeline companies now using AIP.

BigBear.ai’s tech also isn’t just limited to defense, with it being used in the manufacturing, life sciences, and logistics industries. On the commercial side, you can find its threat detection systems in major U.S. airports like Dallas-Fort Worth and Denver International.

Internationally, the company is starting to gain traction as well. One example is its partnership with Smiths Detection, where BigBear.ai’s algorithms are being used to help automatically detect prohibited items in luggage. These are integrated with CT scanners and are helping the company open up new global distribution channels for its threat detection tech.

Different growth and margin profiles

While both stocks have been great performers over the past year, their revenue growth has been much different. Palantir has been seeing accelerating revenue growth as U.S. commercial customers flock to AIP and the U.S. government begins to embrace AI. Last quarter, its revenue surged 39% to $883.9 million, marking the seventh straight quarter its revenue growth has increased.

| Metric | Q2 ’23 | Q3 ’23 | Q4 ’24 | Q1 ’24 | Q2 ’24 | Q3 ’24 | Q4 ’24 | Q1 ’25 |

|---|---|---|---|---|---|---|---|---|

| Revenue growth | 13% | 17% | 20% | 21% | 27% | 30% | 36% | 39% |

Data source: Palantir quarterly reports.

BigBear.ai’s revenue growth, on the other hand, can best be described as lumpy. Last quarter, its revenue rose just 5% to $34.8 million. However, in 2024, it had one quarter where revenue declined by 21% (Q1), and another quarter where revenue jumped 22% (Q3). Government spending can be unpredictable, which has shown up in BigBear.ai’s results.

There is also a big difference between the gross margins of Palantir and BigBear.ai. Gross margin is an important metric, since it is directly tied to how easily a company can turn revenue into profits. Palantir has classic high software gross margins, checking in at 80.4% last quarter.

BigBear.ai’s gross margin, meanwhile, was only 21.3% in Q1. This stems from BigBear.ai still being more of a systems integrator and government contractor than a software AI company. Its engineers and data scientists must co-locate and be on-premises for many of its government projects, which adds a lot of costs.

Which is the better AI stock?

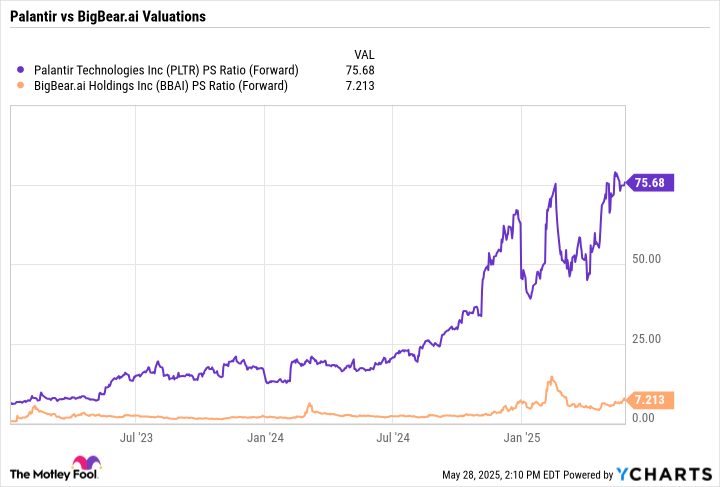

When it comes to valuation, BigBear.ai is the much cheaper stock, trading at a forward price-to-sales (P/S) ratio of 7.2 times 2025 analyst estimates, versus 75.6 times for Palantir. Based on that metric, its valuation is less than a tenth of its rival AI stock.

PLTR PS Ratio (Forward) data by YCharts

That said, Palantir has much better revenue growth and predictability, as well as vastly superior gross margins. It clearly has the more attractive business model, and the opportunity in front of it is enormous.

As such, I think Palantir is the better stock to own over the long run, despite its high valuation.