Leisure and entertainment giants Carnival (CCL -2.59%) and The Walt Disney Company (DIS 0.58%) offer an abundance of options for anyone thinking about taking a vacation this summer. The two companies can also represent compelling investments, with both stocks gaining momentum in recent months.

Can the rally keep going? Let’s discuss whether shares of Carnival or Disney are the best buy for your portfolio right now.

Image source: Getty Images.

The case for Carnival stock

As the world’s largest cruise line operator, Carnival is capitalizing on an industry renaissance, with data suggesting that this form of vacation travel is more popular than ever. Efforts to optimize its fleet and enhance financial efficiency are paying off, with the company posting multiple operating records.

In the first quarter (for the period ended Feb. 28), Carnival management noted “incredibly strong demand,” which helped results outperform prior guidance. Revenue of $5.8 billion increased 7.5% year over year, fueled by climbing capacity and higher pricing. Carnival ended the quarter with $7.3 billion in customer deposits for future voyages, surpassing last year’s $7 billion record.

Even more impressive has been Carnival’s ability to control costs, translating into surging profitability. Adjusted earnings per share (EPS) of $0.13 reversed a loss of $0.14 in the prior-year quarter, underscoring the company’s newfound financial consistency. The expectation is for these trends to continue. The launch of Celebration Key, a new private island destination opening in July, and the delivery of three new ships by 2028 should drive further growth.

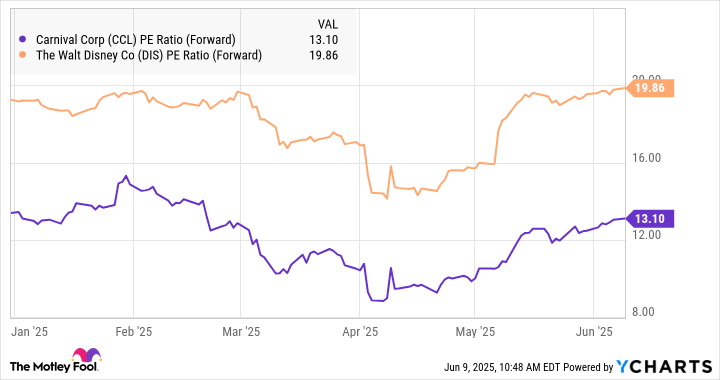

Carnival is guiding for full-year EPS of $1.83, representing $2.5 billion in adjusted net income and marking a 29% increase from 2024’s result. The outlook is encouraging as it should allow the company to improve its balance sheet. The current total debt position of $27 billion is favorably down $4 billion over the past year. Deleveraging should support a higher valuation for Carnival stock, which trades at just 13 times its 2025 EPS forecast as a forward price-to-earnings (P/E) ratio, notably at a large discount to Disney stock’s forward P/E of 20.

The attraction of Carnival as an investment is its combination of compelling value and growth potential. Investors confident that Carnival is sailing in the right direction have plenty of reasons to own the stock for the long run.

CCL PE Ratio (Forward) data by YCharts.

The case for Disney stock

The last few years have been far from a fairytale for Disney shareholders, as the media giant has navigated numerous challenges. Despite record results from its experiences segment that includes the theme park empire and the growing cruise line business, the entertainment business has been forced to contend with volatile box office trends and a reset of expectations in streaming.

Disney stock is down 7% over the past five years, marking a major underperformance compared to the broader market. Yet, the latest trends point to what may finally be the start of a sustained comeback.

In Disney’s fiscal Q2 (for the period ended March 29), revenue increased 7% year over year while adjusted EPS surged 20%. The big story was the robust momentum from the streaming offerings where Disney+ added 1.4 million customers during the quarter, brushing aside concerns that recent price hikes would push subscribers away.

Hulu and the ESPN digital properties have also been growth drivers, with Wall Street cheering Disney’s efforts to bundle packages. Disney is targeting EPS of $5.75 for fiscal 2025, an increase of 16% from last year, with management projecting optimism that the company’s strategic initiatives are gaining traction.

Compared to Carnival, Disney stock benefits from its more diversified profile backed by a globally recognized brand. Ultimately, investors who believe the company is just getting started on its plan to dominate streaming media have a great reason to buy the stock today for a diversified portfolio.

Verdict: Carnival is my pick

Picking between Carnival and Disney as the better stock to buy is tough, as I’m bullish on both and predict each will deliver positive returns in the second half of the year. If forced to pick just one, I predict Carnival stock will outperform on the upside. In my view, Carnival’s growth story is still underappreciated by the market, which means its stock may be undervalued and could be poised to break out higher.

Dan Victor has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Walt Disney. The Motley Fool recommends Carnival Corp. The Motley Fool has a disclosure policy.