Here’s our initial take on ASML‘s (ASML -8.75%) fiscal 2025 second-quarter financial report.

Key Metrics

| Metric | Q2 2024 | Q2 2025 | Change | vs. Expectations |

|---|---|---|---|---|

| Net sales | 6.2 billion euros | 7.7 billion euros | 24% | Beat |

| EPS | 4.01 euros | 5.90 euros | 47% | Beat |

| New units sold | 89 | 67 | -25% | n/a |

| Net bookings | 5.6 billion euros | 5.5 billion euros | -2% | n/a |

ASML Management Is Unsure About 2026 Growth

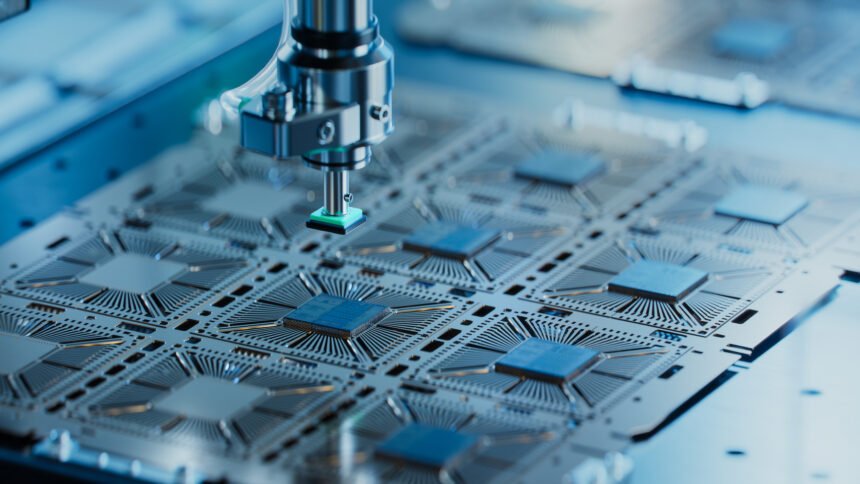

ASML is the world’s go-to supply of high-end lithography equipment used to manufacture microchips, with its most expensive systems selling for nearly $400 million each. The company stands to be a major beneficiary of the AI boom, which is fueling demand for more chips and the machines that produce them, but the high price of its systems tends to result in quarter-to-quarter choppiness.

ASML posted revenue and earnings up 24% and 47% year over year despite selling fewer systems this quarter. Lithography equipment varies in price based on the sophistication of the device, implying that the company is seeing strong demand for its newer, cutting-edge technology. Net bookings in the quarter came in flat at 5.5 billion euros, of which 2.3 billion euros was for higher-end systems.

The company generated a gross margin of 53.7% in the quarter.

But the company is worried about storm clouds on the horizon. ASML’s semiconductor customers have been dealing with heightened uncertainty due to trade restrictions and tariff policies, creating questions about orders heading into 2026.

CEO Christophe Fouquet said, “AI customers’ fundamentals remain strong,” but ASML is seeing “increasing uncertainty driven by macro-economic and geopolitical developments.”

Fouquet said that while ASML is still preparing for growth in 2026, “we cannot confirm it at this stage.”

Immediate Market Reaction

Investors were focused on the commentary about 2026, and not the second-quarter results. ASML shares were down 8% in premarket trading ahead of the New York Stock Exchange open.

What to Watch

Although ASML’s cautious guidance about 2026 is weighing on investors post-earnings, the long-term growth story is still intact. The company is a vital piece in the supply of arguably one of the most important components of the global economy, and with AI spending and other digital efforts likely to continue to build for years to come, there should be solid demand for semiconductors and the machines needed to make them.

The geopolitical situation is rapidly changing. Just this week, the U.S. reversed a ban on Nvidia (NVDA 0.27%) selling its H20 chips in China. In a recorded interview posted on ASML’s website accompanying earnings, the company’s chief financial officer, Roger Dassen, attributed the second-quarter beat in part to tariffs having a “less negative” impact than anticipated.

If that trend continues, ASML’s caution about 2026 could prove to be overly conservative.