GDP growth strengthens banks’ bottom lines. Consumer banking trends drive growth amid a mixed year.

The Caribbean economies have been broadly hit by slowing remittances and a cooling internal labor market. GDP for the Caribbean countries and territories from which our winners are selected is estimated by the International Monetary Fund (IMF) to have grown an average of 2.5% in 2024.

On the banking side, consumer-focused trends such as expanding loan portfolios and digital inclusion were the stars of the show. New customer acquisitions drove sustained numbers across the board despite challenging conditions.

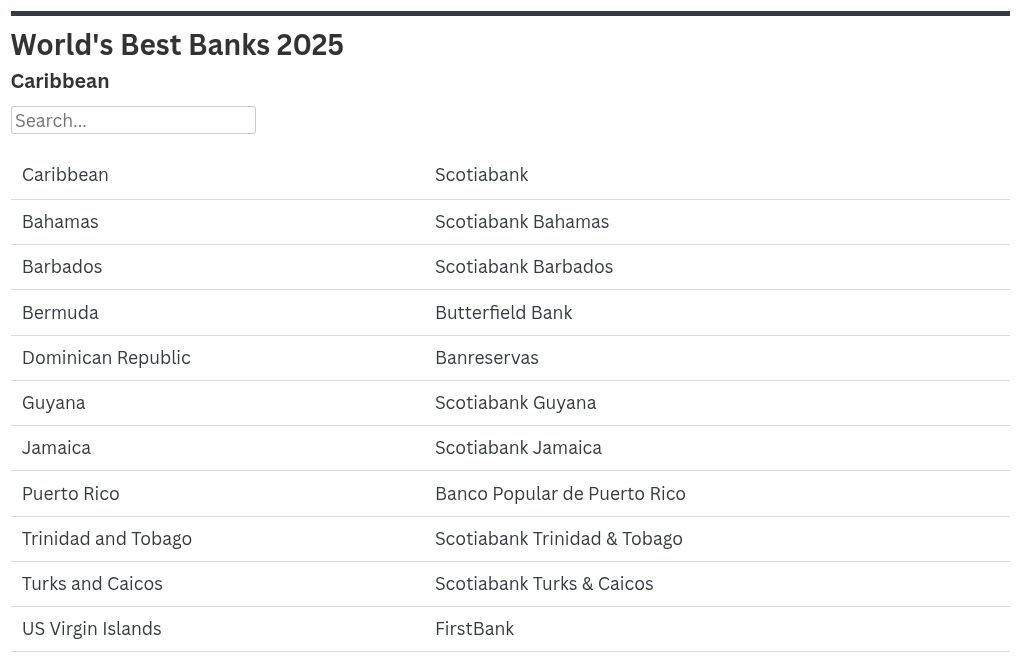

Regional Winner

Audrey Tugwell Henry, CEO, Scotiabank Jamaica

Best Bank in Caribbean | SCOTIABANK

Against this backdrop, Scotiabank, our Best Bank in the Caribbean, de-risked out of its Central and South American operations to focus on unlocking potential in the Caribbean.

As a result, the Canadian giant posted significant growth in its International Banking segment, which generated adjusted earnings of nearly $2.9 billion in 2024, up 11% year over year (YoY).

This increased regional focus also enabled the bank to take home awards in several geographies.

Country, Territory and District Winners

Bahamas | SCOTIABANK BAHAMAS

Scotiabank Bahamas’ continued digitalization efforts proved a game changer, with over 99% of all banking activities now conducted through digital channels. More than 79,000 clients utilize online and mobile banking services.

Barbados | SCOTIABANK BARBADOS

Scotiabank Barbados’ revamped Scotia OnLine Banking platform led the bank to double deposit-account sales YoY. As a result, Scotiabank’s net profits in the country jumped 21.6%, with return on equity surging from 14% in 2023 to an impressive 23% in 2024.

Bermuda | BUTTERFIELD BANK

Butterfield Bank took advantage of its huge margins to achieve above-average profitability in the Cayman Islands and Bermuda. In the latter, it increased its net income by 11.4% YoY. In the former, the secret was an ever-improving efficiency ratio, which posted at 60.4% for the year.

Dominican Republic | BANRESERVAS

In the fast-growing economy of the Dominican Republic, where the IMF estimated GDP growth was estimated at 5.1% for the year, Banreservas leveraged its leadership to become the first Dominican bank to reach 1 trillion Dominican pesos (about $16 billion) in total assets. It continued to lead the market with a 36% share of total assets and 31% of loans.

Jamaica | SCOTIABANK JAMAICA

Scotiabank Jamaica’s efforts to improve customer experience resulted in improved Net Promoter Score (NPS) across all channels: Digital NPS increased 33% to 42%, contact center NPS rose 28% to 32%, and branch NPS had a massive improvement, from 6% to 51.7%.

Puerto Rico | BANCO POPULAR DE PUERTO RICO

Strong loan growth was the secret behind Banco Popular de Puerto Rico’s award-winning performance. The combination of improvement in cost performance and new customer acquisitions led to a solid 10% increase YoY in adjusted net income.

Trinidad and Tobago | SCOTIABANK TRINIDAD & TOBAGO

Scotiabank Trinidad and Tobago’s focus on digitalization drove significant profitability in the country, where digital platforms remain a growth avenue, representing around 72% of total clients as of 2024. It also achieved record-breaking loan growth of $2.1 billion (12%)—its highest single-year increase ever—driven by strong performance in retail and commercial segments.

Turks and Caicos | SCOTIABANK TURKS & CAICOS

Similar trends earned the bank the award for the Turks and Caicos, where increased technological investments by Scotiabank Turks and Caicos helped to secure its leading position in clients and assets.

US Virgin Islands | FIRSTBANK

Increasing loan profitability was also the secret to FirstBank’s thriving year in the US Virgin Islands, where commercial and construction loans related to higher utilization of a government line of credit boosted numbers across the board.