Shares of Hims & Hers have crushed the market over the last year.

When it comes to stocks that continue to beat the market, my guess is that your mind goes straight to companies leading the charge in artificial intelligence (AI). Sure, stocks such as Palantir Technologies or CoreWeave remain red-hot in a strong technology sector.

But smart investors understand that there are myriad opportunities beyond the usual suspects in tech. One company that has emerged as a new favorite among investors is telemedicine business Hims & Hers Health (HIMS 6.96%). With shares up 157% over the last 12 months as of market close June 4, Hims & Hers Health looks like the next monster growth stock at the intersection of healthcare and technology.

Let’s assess the state of Hims & Hers’ business and then take a look at what Wall Street thinks. Is buying shares of this telemedicine darling a good idea right now? Read on to find out.

Hims & Hers is a new disruptive force in telemedicine

Hims & Hers is a telemedicine platform that offers patients access to a variety of medications, including for skin care, anxiety, sexual health, and even weight loss.

At the core of the company’s business model is a subscription platform. At the end of the first quarter, Hims & Hers boasted 2.4 million subscribers, which represented an increase of 38% year over year. This translated into revenue of $586 million for the quarter, up by a jaw-dropping 111% year over year.

By keeping its business primarily online, Hims & Hers can benefit in a couple of ways.

First, subscription revenue is recurring and therefore carries high gross margins. Second, by keeping its user base using its offerings, the company has the flexibility to spend less on marketing and invest in other areas, such as technology or research and development, in an effort to bolster customer acquisition strategies.

Per management’s vision, Hims & Hers is doubling down on investments in AI to get a better sense of its customer data. This could be a savvy move, as it may help the company unlock new expansion opportunities.

Image source: Getty Images.

But Wall Street might not be sold just yet

While the ideas above paint a picture of a fast-growing, disruptive new solution in the healthcare space, Wall Street doesn’t seem totally sold on Hims & Hers just yet.

Over the last month, a number of equity research analysts, including Piper Sandler, Citigroup, Bank of America, and Morgan Stanley, have each maintained ratings of neutral, sell, underperform, or equal-weight. Another way of looking at this is that among some of the largest banks on Wall Street, none seem to have a compelling buy rating on Hims & Hers stock.

In addition, the average price estimate among analysts for Hims & Hers stock is roughly $48, implying 12% downside from trading levels as of June 4.

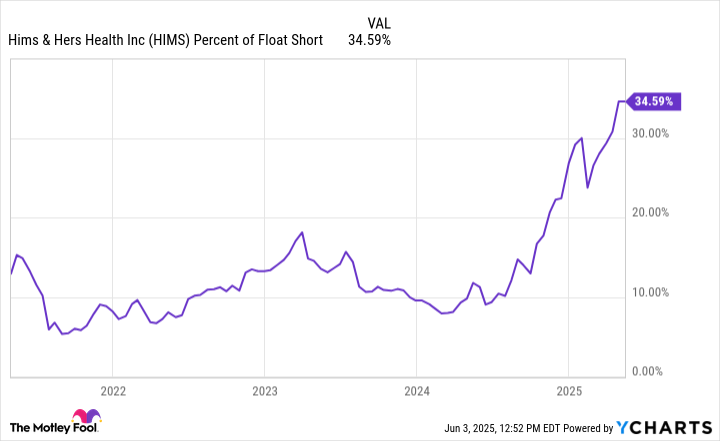

Given Wall Street’s somewhat bearish sentiment, what could be fueling the stock’s seemingly unstoppable rally? I think the company’s high short interest could be the cause of the rise in its stock.

HIMS Percent of Float Short data by YCharts.

Per the chart above, roughly 35% of Hims & Hers float is sold short. Investors who short a stock are betting its price will fall. Short interest of 10% or more is considered unusually high. Not only is Hims & Hers’ short interest much higher than the usual benchmarks, it’s also rising.

A high short interest can fuel volatility and even a rise in a stock’s price if investors who are shorting a stock need to buy shares in the company to return the borrowed shares and close out their position. This is known as short covering, and it often leads to pronounced increases in a stock for a fleeting period of time, adding to volatility. You might be more familiar with these dynamics as a short squeeze.

Despite notable subscriber growth and expanding markets, Hims & Hers stock exhibits too much volatility for my liking, and with that, comes a high degree of uncertainty.

Is Hims & Hers stock a good buy right now?

At first glance, I can understand what makes Hims & Hers look like an appealing investment. Telemedicine represents a compelling opportunity at the intersection of healthcare and technology, and Hims & Hers has certainly proven that it can consistently acquire users and monetize them.

Moreover, the prospects that AI presents in the healthcare space more broadly shouldn’t be discounted — further validating the vision management has for Hims & Hers’ long-term growth.

Nevertheless, I struggle to look past the meme stock type of behavior exhibited here. While some investors have certainly made money owning this stock, I am suspicious if their profits were sparked by the right reasons. Said differently, I view Hims & Hers as more of a swing trading stock (timing is everything) as opposed to a sound long-term opportunity at this time.

For these reasons, I would pass on Hims & Hers at the moment. While I’m intrigued by the company’s potential, I think shares have run up considerably and would not be surprised to see some contraction in the share price sooner than later.

Bank of America is an advertising partner of Motley Fool Money. Citigroup is an advertising partner of Motley Fool Money. Adam Spatacco has positions in Palantir Technologies. The Motley Fool has positions in and recommends Bank of America, CrowdStrike, Hims & Hers Health, and Palantir Technologies. The Motley Fool has a disclosure policy.