IonQ is leading the charge in quantum computing stocks.

So far this year, many of the hottest stocks fueling the artificial intelligence (AI) revolution have taken a breather. As of the closing bell on May 23, shares of Nvidia, Amazon, Alphabet, Apple, and Tesla have negative returns on the year.

With megacap technology stocks showing some signs of fatigue, where else could growth investors be looking? As far as I can tell, those focused on AI have been looking beyond the “Magnificent Seven” and are redeploying capital into emerging opportunities in this sector. One such area that is fetching quite a bit of attention right now is quantum computing.

When it comes to quantum computing stocks, IonQ (IONQ -3.05%) might just be the hottest ticket in town. Shares are up just 9% on the year and currently trade for $45. Is now a lucrative opportunity to buy IonQ stock? Let’s find out.

Analyzing IonQ’s valuation

The graph below shows some interesting trends in IonQ’s valuation over the last year. For most of 2024, its market capitalization hovered around $1 billion. But following October, there was noticeable valuation expansion in the stock. And while shares exhibited some form of a sell-off earlier this year, they have since rebounded. As of May 23, the company’s market cap was sitting at $11.3 billion — close to all-time highs.

IONQ Market Cap data by YCharts.

It’s important to understand that a company’s share price doesn’t tell you too much about the underlying value of the business. While the chart above tells investors that IonQ is valued at $11.3 billion, what does that actually mean?

For smaller companies that are not yet profitable, a good way to benchmark valuation is by looking at the ratio between market cap and sales. This is called the price-to-sales (P/S) multiple. As of this writing, IonQ’s P/S is 231.

To put this into perspective, the P/S ratios for Amazon and Cisco during the dot-com bubble peaked in the range between 30 and 40. Moreover, Nvidia’s P/S ratio hit a high of around 45 during more bullish periods of the AI bull run.

Image Source: Getty Images.

Why is IonQ’s stock going parabolic?

Generally speaking, when a stock suddenly rises by this order of magnitude, there is some sort of catalyst behind the movement. In IonQ’s case, this doesn’t really hold up. During the final months of 2024, many of its peers including Rigetti Computing, D-Wave Quantum, and Quantum Computing each experienced similar pronounced rises in share price.

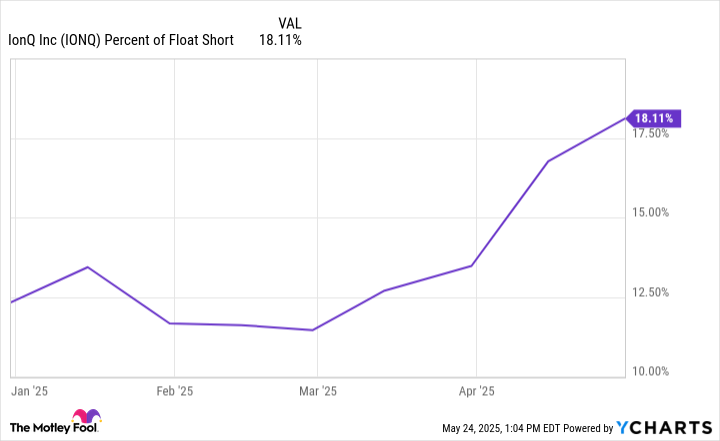

Beyond macro tailwinds across smaller quantum computing stocks, another reason shares of IonQ could be rising sharply right now is due to something known as short covering. Shorting a stock is a financial term that means you are betting on the share price to decline.

From time to time, short-sellers need to buy shares of a stock they are shorting in order to close out their positions. This is known as a short squeeze, and often leads to higher-than-usual increases in a stock price for a brief period.

Per the chart below, IonQ’s short interest has been steadily climbing throughout the year. For reference, a short interest of more than 10% is generally considered higher risk. The company’s short interest is almost double that benchmark. In my eyes, this price action parallels that of a meme stock and not a prudent investment opportunity.

IONQ Percent of Float Short data by YCharts.

What I think could happen sooner than later

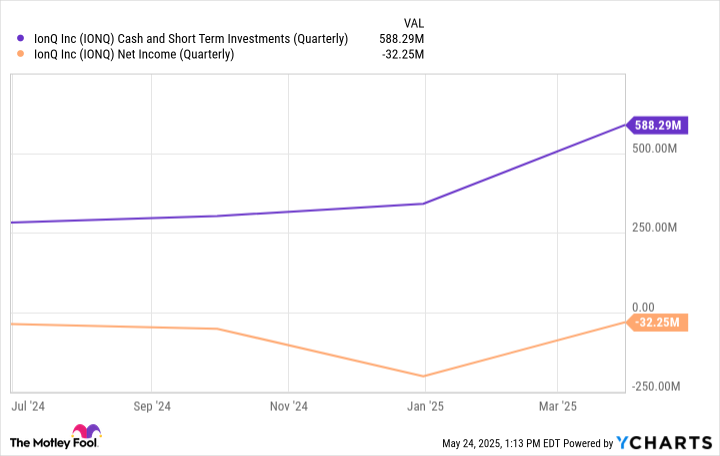

At the end of the first quarter (ended March 31), IonQ held $588 million of cash and short-term investments on its balance sheet. Considering that the company’s quarterly burn rate is currently around $30 million, investors might think the business has ample liquidity.

IONQ Cash and Short-Term Investments (Quarterly) data by YCharts.

I don’t necessarily see it that way, though. For starters, quantum computing is far from a commercialized technology. For this reason alone, IonQ’s revenue growth is likely going to be both unpredictable and fairly mundane over the next several years, at least.

Furthermore, the capital expenditure (capex) and research and development (R&D) costs needed to develop quantum computing is immense. Nvidia, Amazon, Alphabet, and Microsoft are also aggressively investing in this space, so I think IonQ is going to have a hard time keeping up with the competition given its limited financial resources relative to big tech.

Now that the stock is trading back near its highs, I suspect the company may issue shares at its current overextended valuation in an effort to raise capital. If management does do this and you buy the stock at current prices, then you will be diluted.

While IonQ stock may appear cheap at $45, the company is actually being valued in the tens of billions — despite ongoing cash burn, little revenue, high short interest, and an intensifying competitive landscape.

I would not buy IonQ at its current price, and I suspect shares could be looking at a precipitous sell-off sooner than later.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Apple, Microsoft, Nvidia, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Cisco Systems, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.