After plummeting during the stock market sell-off in April, the tech sector has bounced back. The tech-heavy Nasdaq Composite is now back in a bull market and ended June by reaching a new record high.

Are you looking for quality tech companies to add to your portfolio? Here are three leaders in the industry that should be long-term winners.

Image source: Getty Images.

1. Nvidia designs the GPUs crucial for AI technology

You could make a strong argument that no company has benefited from the growth of artificial intelligence (AI) like Nvidia (NVDA 1.28%). Many of the biggest tech companies rely on Nvidia’s graphics processing units (GPUs) for AI and machine-learning tasks. While Nvidia isn’t the only GPU company, it’s widely considered to design the most powerful ones.

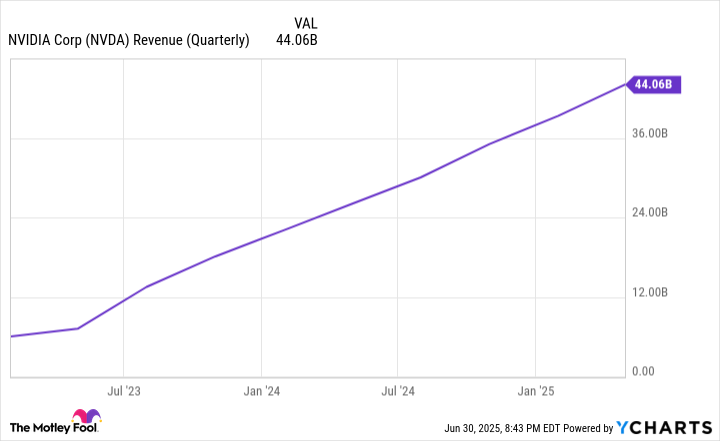

Nvidia has been on an incredible run since the launch of OpenAI’s ChatGPT on Nov. 22, 2022. Revenue has increased by 628% from that point until its most recent quarterly earnings, when it reported revenue of $44.1 billion.

NVDA Revenue (Quarterly) data by YCharts.

Nvidia has some potential downsides. First, it could be overvalued. It’s the largest company by market cap and trades at a forward price-to-earnings ratio (P/E)of 36.8, at the time of this writing (June 30). Nvidia is on the expensive side, although its excellent financial performance arguably justifies the valuation.

Another headwind is that some tech companies, including Alphabet, Amazon, and Meta Platforms, have invested in custom AI chips to better fit their needs. By designing their own chips, they aren’t as reliant on Nvidia.

However, those three companies (and many others) still use Nvidia GPUs and will likely continue to do so, even if they also incorporate custom chips. Plus, Nvidia looks like it will play a key role in sovereign AI — the ability of sovereign nations to advance their AI technology.

In May, Nvidia announced plans to build AI data centers in Saudi Arabia. While Nvidia is likely past its hyper-growth stage, it should continue to be an important player in the growth of AI.

2. Taiwan Semiconductor Manufacturing dominates the global foundry market

Semiconductors are an essential part of most modern electronic devices, including smartphones, computers, and gaming consoles. Taiwan Semiconductor Manufacturing (TSM 0.75%) is the top semiconductor foundry, with a massive 68% share of the global foundry market.

Most big tech companies can’t manufacture chips themselves. Instead, they work with Taiwan Semiconductor, or TSMC for short. It makes chips for a wide range of clients, including AMD, Apple, Broadcom, Nvidia, and Sony.

TSMC’s dominant market position provides a rare mix of safety and growth potential. Since clients depend on TSMC for their chips, its services should continue to be in demand.

It has also been growing rapidly, due to the increase in semiconductor spending. The company’s share price is up 30% over the last year, and it reported $25.5 billion in revenue in Q1 2025, a 35% year-over-year increase.

To top it off, TSMC shares are reasonably priced right now. It trades at a forward P/E ratio of 24, slightly higher than the S&P 500 but less than the Nasdaq Composite.

3. Netflix is the world’s top streaming company

Several entertainment companies have tried their hands at streaming, but none have matched Netflix (NFLX 0.92%) in terms of popularity. It has 301.6 million paid subscribers, nearly 100 million more than any other streaming service. It also accounted for 7.5% of TV and streaming viewing in May, according to Nielsen data.

Netflix started offering ad-supported plans in 2022, a move that has helped it increase its subscriber base and earnings. The streamer reported in May that it has 94 million active users on ad-supported plans, compared to 40 million a year before.

Revenue and operating income are both on the rise — by 13% and 27% year over year, respectively, as of Netflix’s first-quarter earnings report. Overall, this is a strong business that’s delivering excellent financial growth.

The biggest issue is the cost, as Netflix currently trades at a forward P/E of 52.2. Yes, it’s expensive, but it’s also only scratching the surface of its ad business. Analysts estimate that Netflix will make about $2 billion in ad revenue this year, a small portion of the company’s projected revenue of $43 billion to $44 billion. Research firm MoffettNathanson projects that Netflix could reach $10 billion in ad revenue by 2030.

Nvidia, TSMC, and Netflix are at the top of their respective markets, and all three have seen significant growth in their revenue and share prices. If you’re interested in adding to your tech portfolio with proven companies, each of them is worth checking out.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Lyle Daly has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Meta Platforms, Netflix, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.