High-flying growth stocks receive a lot of attention, thanks to their high return potential. However, it doesn’t take picking generational companies to make good money in the stock market. Broad exchange-traded funds (ETFs) have shown they can also do the trick with enough time on your side.

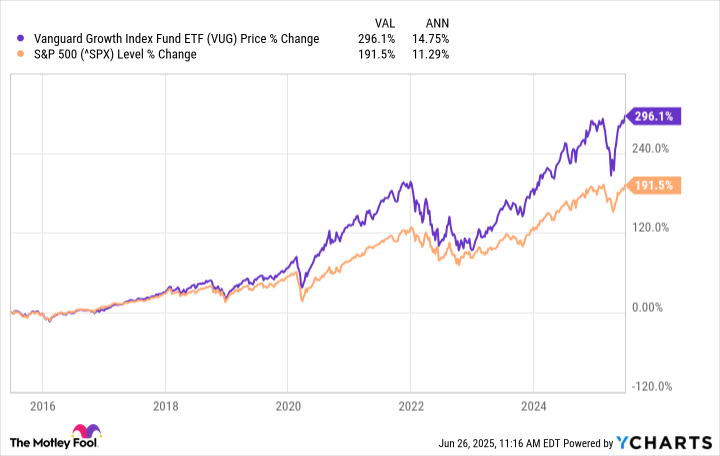

ETFs allow you to invest in dozens, hundreds, and even thousands of companies with a single investment. And although they may not be as sexy as individual stocks, many go on to outperform the broader market (based on S&P 500 returns). The Vanguard Growth ETF (VUG 0.62%) is a great example of this.

Focusing on large-cap growth stocks, VUG has been a rewarding investment and has the potential to turn a $1,000 investment into $50,000 if it continues at its current rate.

Image source: Getty Images.

Stability and growth all mixed into one ETF

Large-cap growth stocks have the potential to be the best of both worlds.

On the one hand, large-cap companies (those with a market cap of at least $200 billion) typically have established business models, are market leaders, and are in good financial health. This helps provide a bit of stability because these companies have diversified revenue streams and the resources to weather rough times in the economy.

On the other hand, these companies are still considered growth stocks because of their strong revenue and earnings growth and their considerable expansion and return potential.

Below are the ETF’s top 10 holdings:

| Company | Percentage of the ETF |

|---|---|

| Apple | 11.61% |

| Microsoft | 10.59% |

| Nvidia | 9.04% |

| Amazon | 6.16% |

| Meta Platforms | 4.04% |

| Broadcom | 3.44% |

| Alphabet (Class A) | 3.24% |

| Tesla | 2.95% |

| Eli Lilly | 2.93% |

| Alphabet (Class C) | 2.63% |

Data source: Yahoo! Finance.

The ETF is a bit top-heavy, but that’s because it’s weighted by market cap, and megacap tech stocks have skyrocketed in valuation over the past half-decade or so. The tech sector represents over 58% of VUG.

How a $1,000 investment can turn into $50,000

This ETF doesn’t have superpowers that can turn $1,000 into $50,000 overnight, but it does have returns that can do so if they continue.

Since hitting the stock market in January 2004, the VUG ETF has averaged around 10.4% annual returns. Over the past decade, its average annual returns have been an impressive 14.7%.

Using 10% and 14% average annual returns, here’s how much a one-time $1,000 investment could go to in different numbers of years:

| Years Invested | 10% Annual Returns | 14% Annual Returns |

|---|---|---|

| 10 | $2,580 | $3,690 |

| 15 | $4,150 | $7,100 |

| 20 | $6,670 | $13,640 |

| 25 | $10,730 | $26,230 |

| 30 | $17,260 | $50,410 |

Calculations by author. Values are rounded down to the nearest ten and take into account VUG’s expense ratio.

Let compound earnings do the hard work for you

Anytime your investment grows a few times over, it’s a good thing, but the real value is created when you continue contributing to VUG instead of a one-time investment.

For the sake of illustration, let’s meet in the middle and assume VUG averages 12% annual returns. Here’s how your investment could stack up based on how much you add monthly:

| Years Invested | $100 Added Monthly | $250 Added Monthly | $500 Added Monthly |

|---|---|---|---|

| 15 | $50,000 | $116,900 | $228,400 |

| 20 | $95,600 | $224,700 | $439,800 |

| 25 | $175,800 | $414,300 | $811,900 |

Calculations by author. Values are rounded down to the nearest hundred and take into account VUG’s expense ratio.

It’s important to remember that these are all assumptions and there’s no way to predict how VUG (or any stock) will perform going forward. However, the most important thing this shows is just how effective compound earnings can be at creating wealth in the stock market.

What you may lack in a lump sum to invest, you can make up for with consistency and time. Don’t underestimate the power of both.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Stefon Walters has positions in Apple and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Tesla, and Vanguard Index Funds-Vanguard Growth ETF. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.